If you’re debating whether or not to purchase an investment property in the UK, the time is now.

With so many high-quality buy-to-let properties for sale across the UK, investors can rely on a solid investment in UK property to achieve high ROI and a steady income stream.

Table of contents

Why is Investment Property For Sale In The UK So Popular?

There are several reasons why more investors are looking to the UK’s property market when looking for investment property for sale.

1. Healthy Rental Market

The private rented sector makes up a fifth of the UK’s housing market. Issues like the cost-of-living crisis and high mortgage rates mean more people are putting off buying a home and choosing to rent for longer. ¹

The increased demand for high-quality rental properties is likely to continue long-term, offering a consistent income stream for investors. ²

2. High Quality Developments

Investors can take their pick from a wide range of excellent investment properties for sale in the UK.

Thanks to advances in areas like energy efficiency and construction, as well as robust legislation, the UK housing market boasts higher quality builds that investors can trust. ³

3. Excellent Affordable With High ROI

House prices in the UK remain incredibly competitive, and it’s possible to invest in a high-quality buy-to-let property for sale in the UK for an exceptional price, increasing your ROI over time.

The Options For Investment Properties In The UK

There’s a wide variety of investment properties for sale in the UK, depending on the specific requirements of the individual investor.

The traditional buy-to-let option, where income is raised through rent from tenants, remains popular. Many developers build new homes with the buy-to-let option in mind. ⁴

Buy-to-sell is also a possibility, whereby the investor buys a property with a view of selling it to another buyer, perhaps after a refurbishment programme that would see a healthy ROI. ⁵

Many larger buy-to-let properties for sale in the UK have the potential of being converted into HMOs. This option tends to produce higher rental yields compared to traditional buy-to-let properties. ⁶

What Makes A Good Investment?

With so much investment property for sale in the UK, it’s important to choose a property that suits your needs, both now and in the future.

If you’re considering a buy-to-let property for sale in the UK, researching the average rent in the local area is essential. Make sure the property in question can produce enough income to cover the costs of your mortgage payment, taxes and other expenses. ⁷

Understanding the area in which your potential investment sits will also help you make a sound investment. The neighbourhood surrounding the property will make a big difference to the tenants you can expect to attract and your vacancy rate.

For example, if the property is near a university, the majority of potential tenants will likely be students, which could leave you struggling to fill your property over the summer. ⁸

The Heaton Group Can Help Invest In The UK Housing Market

If you’re ready to reap the rewards of an investment property for sale in the UK, the Heaton Group can show you the fantastic opportunities that await when you turn your gaze North.

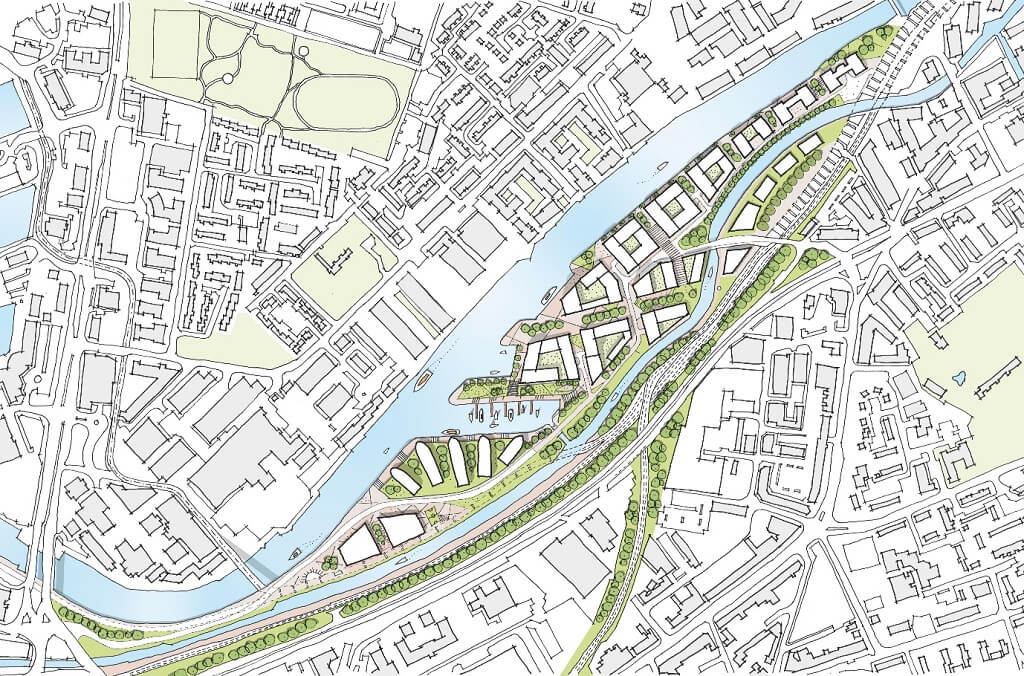

We have over 50 years of experience creating exceptional developments, like our luxurious waterfront Tranquillity, perfectly placed between Manchester’s vibrant city centre and Salford’s MediaCityUK.

Cities in the North West, like Manchester and Bolton, are enjoying extensive reinvestment and growing populations, presenting a lucrative opportunity for property investors looking to take advantage of lower house prices in the UK.

Our buy-to-let developments average rental yields of over 6.9%, and each property is protected by a 10-year structural warranty as standard, giving you peace of mind.

What’s more, securing one of our buy-to-let properties off-plan lets you acquire the property at a price Below Market Value upon project completion.

Contact us today for more information about our developments and how we can help you enter the UK housing market.

Sources

- Residential investors flock to thriving UK rental market

- Investing In UK Property: Pros And Cons – Yield Investing

- New-build housing – how regulation can improve the consumer journey

- A Complete Guide to Property Investment

- Top 8 Property Investment Strategies

- The 7 Best UK Property Investment Strategies For Success in 2025

- 10 Factors to Consider When Buying an Income Property

- 10 Factors to Consider When Buying an Income Property