Affordable houses, high rental yields, and regeneration projects are just a few reasons why buying property in Manchester is so popular with investors right now.

This UK’s top investment hotspot isn’t set to slow down anytime soon, with a population of over 600,000 in the city centre, drawing more people in due to lower living costs than London.¹

It’s predicted Manchester’s population will grow by another 10% in 2025 ², attracting young professionals and students thanks to the growth of industries such as tech and finance.

All this high demand for rentals and affordable property prices make Manchester and surrounding areas a haven for investors.

Table of contents

The Driving Factors Behind Manchester’s Growth

Named as one of Europe’s fastest-growing cities in 2023 ³, the main factors behind Manchester’s success are economic growth, infrastructure developments, and employment opportunities.

Economic Growth

Manchester is one of the top economic hubs outside of London, focusing on tech, finance, and media. From 2010 to 2020, over the last decade, we’ve seen the economy grow by 39% to £78.7 billion in total.⁴

The city has attracted significant investments over the past few years and is ranked as the top city in the UK for foreign direct investments.⁵

Infrastructure Developments

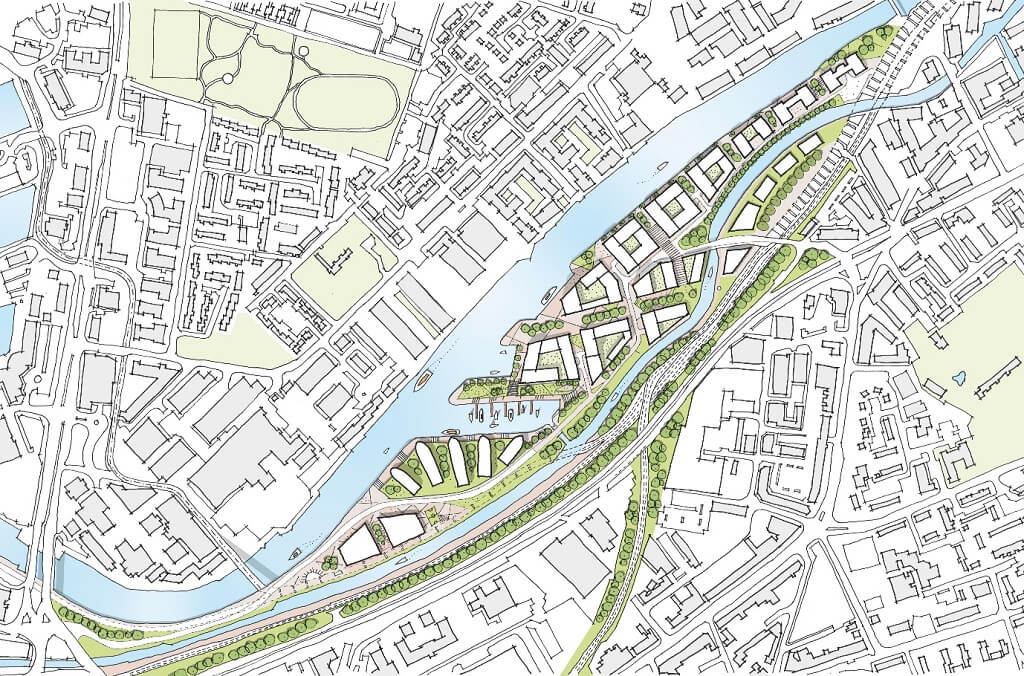

Manchester is constantly running regeneration projects and improving its infrastructure. For example, the Manchester airport transformation programme, a £1bn investment programme which will expand terminal 2 to accommodate more passengers.

There are also previous developments, such as the NOMA development programme, which completed new office and public spaces, and the rumoured metro link expansion to improve connectivity.

Employment Opportunities

The tech and digital sector of Manchester is huge, employing over 88,000 people with over 10,000 businesses.⁶ Manchester as a whole has an employment rate of 72%.⁷

The lower cost of living in Manchester makes business opportunities more enticing than in London; for example, Manchester office rental rates are 32.5% lower than London⁸, and the cost of living is around 20% lower.⁹

Manchester Property Investment Vs London Property Investment

Both London and Manchester attract a lot of attention from investors due to their high growth rates. However, Manchester takes the lead due to its affordability and high ROI.

For example, Manchester’s property prices are significantly lower than London’s; in July 2024, London’s average property cost was £523,000, while Manchester’s came in at £234,000.¹⁰

Due to Manchester’s growing population and increased demand, the Manchester rental yield is high, averaging around 6.5% in 2024 compared to 4.95% in London.¹¹

As an investor, Manchester’s high growth rate combined with an excellent ROI makes it a more attractive investment in comparison to London.

Manchester’s regeneration projects and dynamic economy make it a long-term win.

Buying Property In Manchester – Which Type Of Investment?

The most in-demand property type is residential buy-to-lets in Manchester due to the young professional population, especially in parts like the Northern Quarter due to its central location.

Student accommodation is also a popular investment due to the University Of Manchester and Manchester Metropolitan University. Luxury apartments are also on the rise with affluent professionals.

Some key neighbourhoods to consider are Ancoats, the Northern Quarter, and Salford Quays.

The Heaton Group has an upcoming development located strategically between MediaCityUK and Manchester called Berkeley Square; this development consists of 500 luxury apartments and could be an excellent off-plan property in Manchester investment.

We also have several other buy-to-let options in Preston, Greater Manchester and Manchester.

Manchester Property Investment With The Heaton Group

The Heaton Group is a family-run property developer with over 50 years of experience in creating developments in Manchester and surrounding areas.

Our buy-to-let developments all have an average rental yield of over 6.9% and a 10-year structural warranty. We also allow investors to buy off-plan property at below-market value for better ROI.

Manchester is becoming a property investment hotspot in comparison to London, thanks to its fast economic growth, affordability, and ongoing developments.

Now is the ideal time to secure your Manchester property investment, with prices set to rise by 24.3% in 2026, according to Savills.

Contact us today for more information about our buy-to-let properties in Manchester or any off-plan development investments.

Sources

- Introduction | Future Manchester. An economy built on people, place and prosperity | Manchester City Council

- Manchester Today: Useful Stats – CityCo

- Manchester Today: Useful Stats – CityCo

- Invest In Manchester | Greater Manchester’s economy

- Manchester remains a top UK city for Foreign Direct Investment | Greater Manchester Business Board

- How we developed this strategy | Manchester Digital Strategy 2021 – 2026 | Manchester City Council

- Manchester’s employment, unemployment and economic inactivity – ONS

- How Much Does it Cost to Rent Office Space in the UK

- Cost of Living Comparison Between London, United Kingdom And Manchester, United Kingdom

- Are you really better off investing in Manchester property over London?

- The highest yielding areas for buy-to-let property in the UK