The recent budget announcement, introducing new stamp duty rules that increase stamp duty to 5% for second homes in England and Northern Ireland, may initially seem like a hurdle for property investors. But these changes, while adding an extra cost to secondary home purchases, also highlight an ideal moment to consider off-plan property investments. Here’s why the current landscape makes investing in off-plan properties a timely and strategic choice.

Table of contents

Why Off-Plan is More Attractive Now than Ever

The new stamp duty rate on second homes creates a higher upfront cost, which can deter many investors from competing in the buy-to-let market. Yet for those looking at off-plan properties, this reduced competition brings significant advantages:

- Lower Purchase Competition: As fewer buyers are willing to pay the additional stamp duty on existing secondary properties, off-plan investors may find themselves in a more favourable position, free from high levels of buyer competition. This means better access to prime properties and the chance to secure them at attractive prices.

- Future Value Growth: Locking in an off-plan property now allows investors to benefit from the current market dynamics, even if prices are subdued today. By 2026, when these properties complete, the market could well have rebounded, resulting in capital appreciation for those who invested early.

- Avoiding the Immediate Cost Hikes: Off-plan purchases often involve phased payments over several years, meaning investors aren’t hit with the total transaction cost upfront. This is particularly beneficial given the recent stamp duty increase, as it allows time to plan and manage finances more effectively.

Making the Most of Demand Shifts

Alongside the new stamp duty rules, upcoming changes in the first-time buyer threshold are expected to affect market demand. In March 2025, this threshold will revert to £300,000, likely sparking a rush of first-time buyers looking to make purchases before this point. For off-plan investors, this scenario brings several key benefits:

- Increased Market Demand: As first-time buyers flood the market, property values are likely to rise. Those who secure off-plan properties at today’s prices stand to benefit from this demand-driven value boost.

- More Favourable Selling Conditions: For investors considering a sale after completion, the increased interest from first-time buyers could mean a quicker sale at a better price, providing a clear pathway for potential returns.

Tightening Rental Market

With the stamp duty hike discouraging traditional buy-to-let investors, the availability of rental properties may become limited. For investors in off-plan properties, this translates into an exciting opportunity to meet growing rental demand and generate consistent income.

Benefits for off-plan investors in the rental market:

- Higher Rental Income Potential: Fewer available rental properties mean off-plan investors could command higher rents, especially in high-demand areas.

- Competitive Edge: Off-plan properties, often designed with modern renters in mind, tend to be more attractive than older properties, adding to their rental appeal and increasing occupancy rates.

Why Now Is the Time for Off-Plan Investment

The current landscape of new stamp duty rules presents a unique moment for forward-thinking investors to act. By securing an off-plan property, investors sidestep immediate transaction costs, benefit from reduced competition, and position themselves for long-term growth in a recovering market. The potential for capital appreciation, bolstered by the anticipated demand surge from first-time buyers, adds even more appeal to this approach.

Top Reasons to Invest Off-Plan Now:

- Take advantage of reduced competition in the buy-to-let market due to increased stamp duty.

- Lock in a lower purchase price today with potential capital appreciation by 2026.

- Enjoy flexibility with phased payments, avoiding the upfront stamp duty burden.

- Prepare for rental demand growth, capitalising on limited supply and increased rental income.

Conclusion

For those ready to make a smart, strategic move, the new stamp duty rules underline why investing in off-plan properties is especially timely. While traditional property purchases face higher transaction costs, off-plan investments offer a cost-effective, flexible alternative with strong potential for future growth. By acting now, investors can position themselves to make the most of these market conditions, reaping the rewards of well-timed investment in a transforming landscape.

Wondering How the New Stamp Duty Rules Impact Your Next Move?

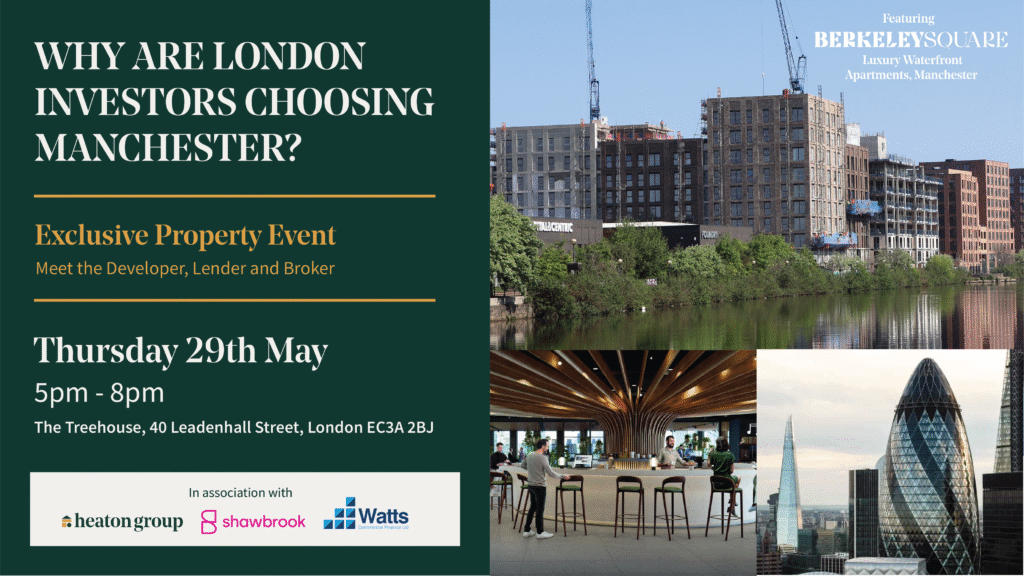

If you’re curious about how these changes could shape your property investment plans, our team of property advisors at The Heaton Group is here to help. We’ll break down what the new stamp duty rules mean for you and explore how our off-plan properties can fit into your goals.

Reach out today—let’s chat about how we can make your investment journey a success in this changing market!