In recent years, we’ve seen a surge in the number of people making a conscious decision to rent instead of buy, with around 11 million people in the UK described as renters. ¹

The current housing landscape means that more people are looking for new build apartments to rent. With more people renting for longer, tenants are expecting more from a rental home.

Build-to-rent homes, designed and built specifically for the rental market, have the potential to be lucrative investments, especially for those looking to stake a claim in the Manchester property market.

What Are More People Renting

There are many reasons why more people in the UK are choosing to rent. Buying a home has always been expensive, but with rising interest rates and the difficulty first-time buyers have getting a mortgage, more people are avoiding the tribulations of buying a home and choosing to rent for longer. ²

With more people choosing to rent, the demand for high-quality homes and new build apartments to rent has skyrocketed. Tenants expect modern homes with high-quality finishes, so the demand for such homes is high. ³

The high demand for rental properties is exacerbated by a lack of available properties. This is down in part to many landlords choosing to cut their losses and sell up rather than deal with the stricter regulations, rising costs and economic pressures that come with renting out a property. ⁴

Why Are Build-to-Rent Developments So Lucrative

When we take the UK’s current rental market into account, it’s no surprise that build-to-rent schemes are a great option for investors.

Build-to-rent homes, as the name suggests, have been designed and built with the rental market in mind. With potential tenants demanding more from rental properties, build-to-rent homes are built to high specifications with high-quality finishes and all the mod-cons tenants want and expect. ⁵

Tenants don’t just prefer new build apartments to rent; they’re also prepared to pay high monthly rents for them. Therefore, those who invest in build-to-rent properties can expect much higher rental rates. Furthermore, as renting has become a long-term solution for many people, tenants are more likely to stay in a property. The prospect of a rental property lying empty is greatly reduced. ⁶

How Does All This Affect The Manchester Property Market?

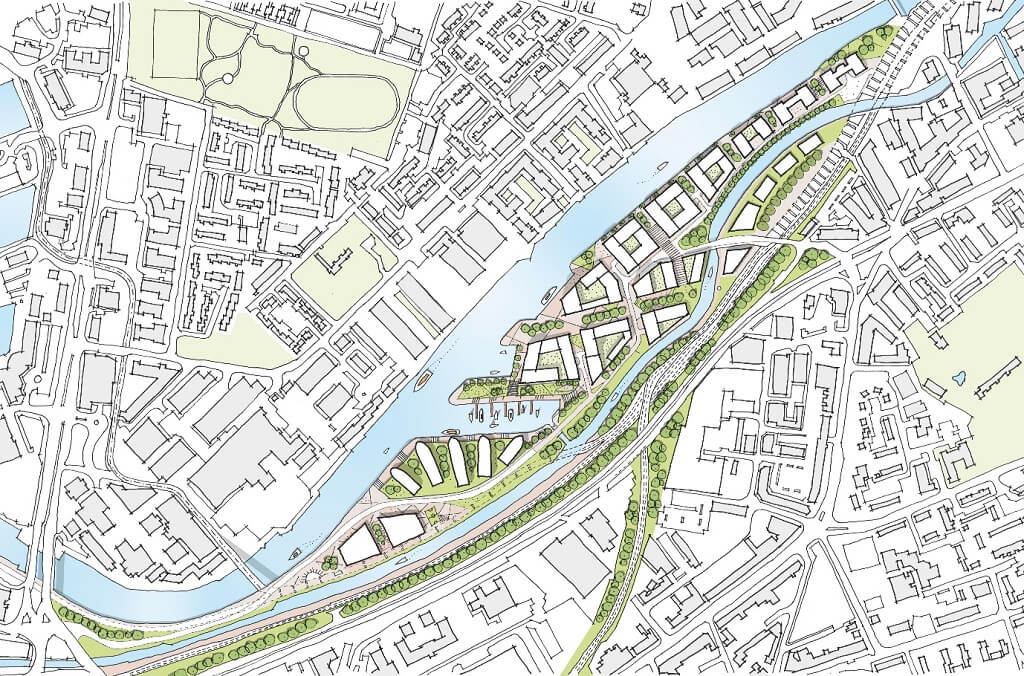

Manchester has transformed in the last decade thanks to a range of extensive regeneration and investment projects. These projects have seen the population of Manchester boom as more and more people look to enjoy the benefits that the new-look city has to offer for both work and leisure.

All these people need homes. Although house prices in Manchester are lower than the national average, more people are choosing to rent, for the reasons we discussed earlier. With this in mind, high-end build-to-rent developments have the potential to be incredibly lucrative.

Compared to elsewhere in the country, investors can expect to enjoy higher rental yields in Manchester. In 2024, the average rental yield in Manchester was 6.5%, compared to 4.95% in London. ⁷

This is in part due to Manchester’s popularity as a thriving and cosmopolitan city to live and work in, but it’s also due to the high-quality build-to-rent developments on offer. Potential tenants expect more for their money, and developments like Berkeley Square and Tranquillity, situated between the city centre and Salford’s MediaCityUK, meet and far exceed those expectations.

Enter The Manchester Property Market With The Heaton Group

If you’re seeking to enter the Manchester property market with a buy-to-let property, our award-winning team, with their in-depth knowledge of the UK housing market, can help you achieve your goals.

With 50 years’ experience in creating exceptional developments in Manchester and the North West, we can offer investors a varied range of buy-to-let properties in the region.

Our buy-to-let developments have average rental yields of over 6.9% and feature a 10-year structural warranty. We also allow investors to buy off-plan property at below-market value for better ROI.

If you’d like to explore the benefits of adding one of our impressive buy-to-let properties to your portfolio, contact us today to find out more.

Sources

- Why are rents so high and will they keep going up?

- Is There a High Demand for Rental Properties in 2025?

- Build-to-Rent Pros and Cons

- Spike in landlords putting properties up for sale as tougher rules, mortgage hikes and taxes bite

- Build-to-Rent Pros and Cons

- Build-to-Rent Pros and Cons

- The highest yielding areas for buy-to-let property in the UK