Thinking of investing in UK property? Over the last few years, it’s been proven that the UK remains a popular location for overseas investors.

Despite recent economic hardship, the British housing market has remained stable, with an estimated value of $21.99 trillion in 2024.¹

There are many reasons why UK property investment is so attractive to overseas investors: the strong demand for rental properties, low taxation, and attractive ROI.

In particular, GCC (Gulf Cooperation Council) investors are predicted to reach $3.2 billion in 2024.² It’s easy to see why, with excellent higher education opportunities, the introduction of ETA, and an emerging luxury property scene just being some of the opportunities buying property in the UK offers.

Table of contents

The UK Property Market Advantage

It’s no secret the UK has been through its fair share of economic instability over the past few years; but, the new Labour government promises the UK to see a period of economic stability, with inflation dropping to 2% in mid-2024.³ In fact, you can read about the new changes the Labour Government is set to bring here.

Apart from increased demand in the British housing market, this also offers a more stable exchange rate to foreign investors from the GCC. The UK property market also offers great legal protection for buyers from GCC with low taxation rates of just 2% compared to other countries like Hong Kong and easy lending with mortgages for non-residents.

In terms of ROI, in 2023, rental prices grew 7%-8%⁴ in high-demand areas like Manchester and London, with buy-to-let properties resulting in an average rental yield of 5%.⁵

With UK house prices set to rise in 2024 coupled with low interest rates, the UK property market is likely to offer a great return for overseas investors and high capital appreciation long term, especially if you consider investing up North.

The Rise of GCC Investors Buying Property in UK

Saudi and UAE investors have been actively investing in the British housing market; over the last decade, GCC investments have averaged $3.4 billion.⁶

This is mainly due to the excellent exchange rates and the introduction of electronic travel authorisation in 2024, which will encourage more investors and make it easier than ever before for Saudi and UAE investors to travel to the UK for short-term stays visa-free.

It’s said around 73% of Saudi investors are considering UK property investment, with 75% opting for cities like Manchester and Birmingham thanks to their excellent ROI. Estimated house prices in Manchester will increase by 19%.⁷

Here are some other reasons as to why we are seeing a rise of GCC investors in the British housing market –

- High rental demand – There is still a high rental demand due to growing house prices, especially in areas like Manchester, where GCC investors can achieve a yield of 5-6% and the build-to-rent sectors achieve 6-8%.⁸

- Portfolio diversification – The UK is seen as a safe haven investment for GCC investors. UK property investment is a stable, low-risk market, with 90% of Saudi investors considering the UK as their primary property investment location due to the historically strong ROI.⁹

- Political stability – With the strong legal protection for GCC property investors such as clear titles and contract enforcement laws, as well as the new UK Labour government promising housing supply increases.

- Affordable entry prices – For locations like Manchester and Birmingham, entry house prices are quite affordable for most GCC investors, giving them high rental yields and capital appreciation compared to the high housing costs in London.

Why Invest In Finished Or Buy House Off Plan

When investing in the British housing market, you will have a choice to buy a house off plan or invest in a finished property.

Both types of property have their advantages and disadvantages for foreign investors.

Investing In Finished UK Property

- Start earning rental income straight away.

- Reduced risk of construction or developer delays.

- Clear market value for more guided investment decisions.

Investing In Off-Plan Property In the UK

- Lower entry price.

- Customizable.

- Great capital appreciation for GCC investors, especially in high-demand areas like Manchester or Preston.

The Importance Of Education & Safety For GCC Investors

One of the main considerations for GCC investors buying property in the UK is the proximity to high-quality, prestigious UK universities.

The UK is home to many renowned universities, such as Oxford University, Cambridge University, and Manchester University. Properties in safe neighbourhoods around these universities are ideal for GCC parents who want to secure high-quality education for their children.

Investment properties in areas like Manchester also have great capital appreciation thanks to the lower UK house prices in the North and can provide a steady rental income.

Where GCC Investors Are Buying Property In UK

Many GCC investors focus on investing in high-end luxury properties around London. However, there is a trend of GCC investors investing in properties up North, thanks to the high capital appreciation and rental yields.

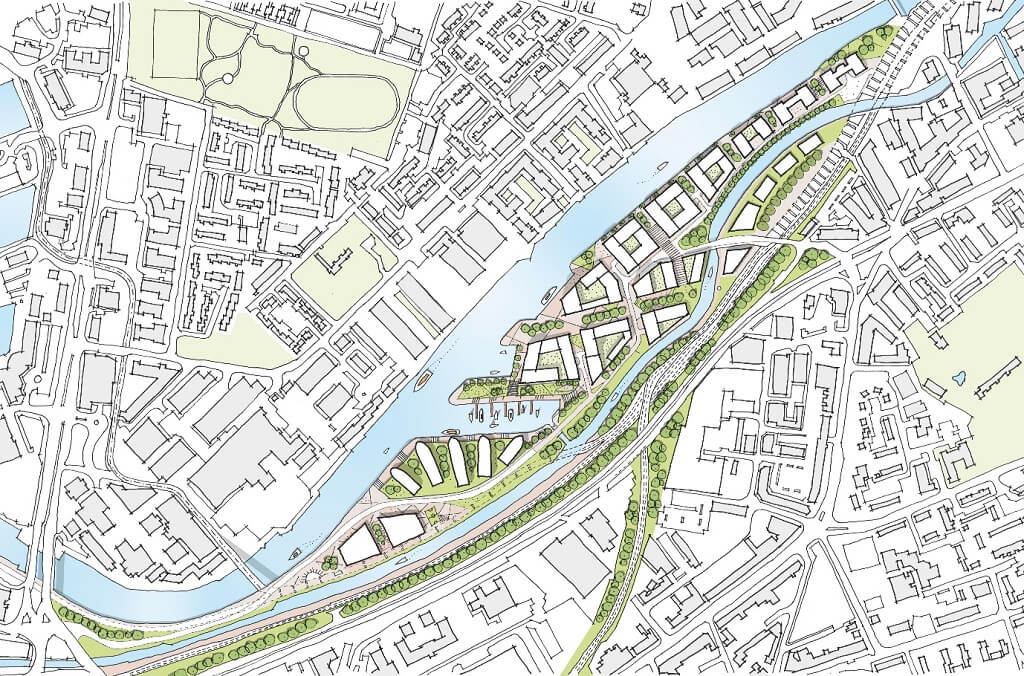

Some examples are The Heaton Group’s current development, Tranquility, situated strategically between Manchester City Centre and MediaCityUK, which consists of 250 one—to three-bedroom apartments.

The development is predicted to have a 6.9% rental yield and attract the young professional population of Manchester, making it a high-demand choice for prospective overseas off-plan investors.

Buying Property In The UK With The Heaton Group

The Heaton Group is a trusted development group known for highly successful developments in Manchester and the North West of England. Having gained over 50 years of experience in the business and an average rental yield of 6.9%, if you’re thinking of investing in a luxury apartment in the North of England, feel free to reach out to our team now.

Some of our high-demand buy-to-let investment property developments ideal for GCC investors are Urban Green in the city center, Stone Cross House for low entry price and high capital appreciation, and Bishopgate Gardens in Preston.

Our most recent property developments are located near transport links and prestigious universities, making them excellent student rentals with a high ROI and perfect for children of investors looking to study in Manchester or surrounding areas.

Get in touch with the team today to discuss any buy-to-let properties you may be interested in investing in or our off-plan developments for high capital appreciation.

Sources

- Why is the UK a Top Property Investment Haven for Investors?

- GCC Residents To Increase Investments In UK Realty

- UK Economic Outlook July 2024 – PwC UK

- UK real estate outlook Q4 2023

- UK real estate outlook Q4 2023

- Saudi Investors Flock to UK Real Estate for Lucrative Opportunities

- Saudi Investors Flock to UK Real Estate for Lucrative Opportunities

- UK real estate outlook Q4 2023

- Saudi Investors Flock to UK Real Estate for Lucrative Opportunities