The Impact Of The New Labour Party Housing Policy

With a new Labour government in charge, there promises to be sweeping changes to the UK housing policy. We outline what these changes mean for UK and overseas investors.

The Labour Party housing policy has promised substantial changes to the housing sector, from rental sector reforms, help for first-time buyers through freedom to buy, housing growth with new developments, and more.

Let’s see the impact of this new Labour housing policy for investors below.

Table of contents

Key Changes in the Labour Housing Policy

There are currently minimal reactions on the markets to the new Labour government, which means we shouldn’t expect a spike in mortgages or house pricing anytime soon till the Spring 2025 budget.

These are the key changes to note with the Labour Party housing policy –

- Sustainable housing – Labour is aiming to reduce the carbon footprint of housing in the UK by retrofitting houses with modern insulation, heating systems, and renewable energy sources.

- More social housing – To provide more affordable housing options for people with lower incomes and address the shortage of affordable housing, ensuring they are included in new developments.

- Freedom to buy – Labour housing plans to make mortgage deposits more affordable for Labour first-time buyers, helping up to 80,000 young people buy their first home.¹

- Stamp duty reverted to £300,000 – Unlike the Tories, whose plan was to relieve some stamp duty tax, Labour is reducing the threshold from £425,000 to £300,000.²

- Building new homes – The Labour housing scheme plans to build over 300,000 new homes annually over the next 5 years to meet their 1.5 million targets, addressing the housing shortage crisis, fast-tracking developments, and prioritising local buyers for local developments.

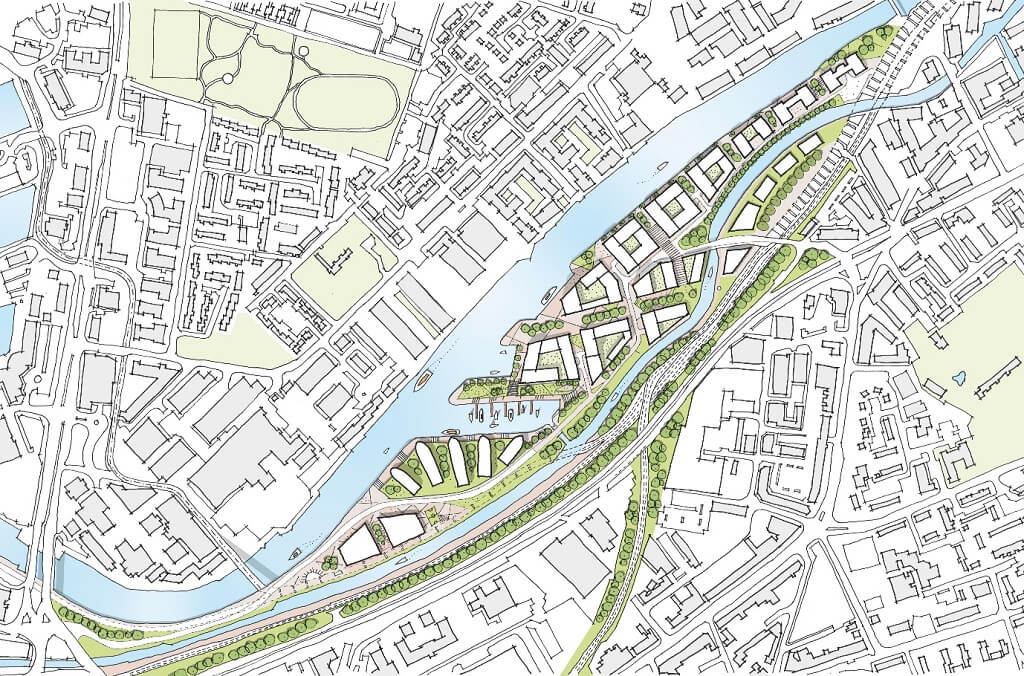

- Brownfield development – They plan to create a new class of ‘grey belt land’ by using low-quality green belt areas to create new developments and also prioritise building on brownfield-used land to lower environmental impact. ³

- Help for renters – Help with annual rent increases and enhance tenants’ rights against eviction by abolishing Section 21 ‘no faults’ eviction to provide a more stable living environment and security to renters.

What Is The Freedom To Buy Scheme?

The Freedom To Buy scheme is available for first-time buyers to reduce the barriers to homeownership for young people. For investors, this means more people will be looking to buy their first home, which means more people will apply for a first-time mortgage, which can help lower mortgage interest rates.

Labour promises to tax foreign buyers and give lower-income buyers more opportunity to buy housing at a smaller deposit price than previously so they can get on the property ladder. This is good news for local buy-to-let investors UK-wise, but for overseas investors, investing in property sooner rather than later is key before these changes come into place.

Buy To Let Investors UK – Why Invest Now?

With developments set to rise, creating over 1.5 million homes, more planning officers, and fast-tracking the approval of brownfield development sites, there’s no better time than now to invest in property.

These new Labour housing policies will increase house demand thanks to affordability, bringing a steady property market and slower price increases. Compared to recent political instability, this period of stability is very attractive to both UK and overseas investors. ⁴

Thanks to the Labour government we will see better rates and mortgage deals from lenders, allowing UK and overseas investors to have access to lucrative properties.

Why Choose North Property For Investors In The UK?

The North of England, in particular, will benefit greatly from these Labour Party housing policy changes since rental yield and demand are already high in areas such as Manchester and Preston.

For example, in Preston, investing in buy-to-let properties for professionals working with employers such as BAE systems and DXC technology in the local area allows for a lucrative return with yields up to 6.9% – check out our Preston development ‘The Exchange’.

On the other hand, Manchester is an attractive location for investment due to its growing economy thanks to the Northern Powerhouse development project, proximity to London (just a 2-hour commute away), and is home to Manchester Airport, which has worldwide connections.

At The Heaton Group, we are often approached by foreign investors, especially from the Gulf region looking to buy high-quality 1-2 bedroom apartments close to The University Of Manchester and Lancashire for their children. Approximately over 150 Saudi students are studying at the University Of Lancashire and Manchester airport makes it easier than ever to fly to Rhiyad in just 6 hours.

We expect to see a surge of Saudi investors in the next few years. In fact, Manchester University’s international students account for 32% of its student population. ⁵

Take a look at our recent successful development Urban Green in Manchester for 1-2 bedroom homes.

Future Stability For Investors In North Property Development – The Heaton Group

Investing in UK housing for overseas investors and local UK residents is looking stable for 2024, reigniting investors’ confidence thanks to political stability and growing Labour housing developments in the UK.

The Heaton Group offers various property developments up North in rental hotspots such as Manchester and Preston, whether you’re looking to invest in buy-to-let properties as an overseas investor or take a look at off-plan developments for a more lucrative return to build your portfolio.

Our most recent in-the-works development in Preston, Farington Square, has 327 contemporary high-grade apartments made to preserve the heritage of the building, a perfect off-plan investment with excellent proximity to the University Of Lancashire and Preston train station.

Contact us today for more information or personalised advice on investing in properties up North with The Heaton Group.

Sources

- BREAKING: Labour to help 80,000 people onto housing ladder

- Labour not to keep stamp duty threshold at higher level for first timers

- Labour sets out plans for building on green belt land

- ‘Clarity and stability’: What investors can expect from the incoming Labour government

- International student statistics at UK universities