Off Plan Property Investment England – Everything You Need To Know

Below Market Value, contemporary new-build designs, and flexible payment plans are just some of the benefits a savvy investor can expect from choosing off-plan property investment in England.

Buying off-plan property has its risks, but for some investors, the rewards outweigh the risks in the long term. With a reduction in mortgage deposit prices due to the new Labour government, off-plan property investment will rise even more in 2024 and beyond.

In particular, off-plan property investment is lucrative for flats/apartments in areas such as Manchester and Preston, where demand is high due to them attracting first-time buyers or younger professional entrepreneurs for rental. Up to 45% of flats are sold before completion compared to terrace houses in the UK.¹

This is why our developments up North, such as The Exchange, have done so well, with an average yield of 6.9% and a growth prediction of 20.4%.

If you’re new to buying off-plan property or looking to build up your investor portfolio, this ultimate guide to off-plan property investment in England is for you.

Table of contents

- Off Plan Property Investment England – Everything You Need To Know

- What Is Off-Plan Property Investment?

- Why There’s No Better Time To Buy Off Plan Property For Overseas Investors

- Rewards Outweigh The Risks – Why Invest In Off-Plan Property

- How To Buy Off-Plan Property In England – Things To Consider

- Top Locations For Off-Plan Property Investment UK

- Buy Off Plan Property In Manchester & North West England – The Heaton Group

What Is Off-Plan Property Investment?

Off-plan property investment is when an investor purchases a property before the construction of the building is completed. Demand is often high for off-plan properties since they offer investors lower buying prices, capital growth, and new amenities.

Developments in high-demand areas up North often sell out fast due to off-plan buyers. Demand is high in these areas but housing is low, producing a better rental yield for investors.

Why There’s No Better Time To Buy Off Plan Property For Overseas Investors

Buying off-plan property isn’t just a strong business venture for local UK buyers, but overseas investors can benefit from investing in off-plan properties, too.

Not only does investing in off-plan property up North offer discounted prices for overseas buyers, but also flexibility and access to housing in high-demand areas such as Manchester.

Manchester has great education opportunities at the University of Manchester, excellent transport links, and growing employment opportunities thanks to local development projects such as the Northern Powerhouse investment fund making it a stable investment choice with a higher than UK average rental yield for overseas buyers.

Apart from this, there is no better time than now to make an off-plan property investment; this is because, with the new housing policies in place from Labour, we can expect a drop in house deposits for mortgages, which will encourage first-time buyers to make a house purchase and reduce mortgage interest rates. By Autumn, it’s predicted the Bank of England will cut interest rates to 5% ² and then fall to 3% in 2025.

Capital growth appreciation is also a factor, house prices are expected to grow over the next few years, with Zoopla stating there will be a 1.5% increase in house pricing for the rest of 2024 and more growth as income growth happens throughout the UK. ³

Before more Stamp Duty tax on overseas investors comes into place (a new policy set by the Labour government to give more chances of buying property for UK residents), making an off-plan investment now is wise.

Rewards Outweigh The Risks – Why Invest In Off-Plan Property

Off-plan property investment in England doesn’t come without its risks, you need to take into consideration the benefits versus the risks before making an informed decision.

Benefits of buying off-plan property in England include –

- Discounted house price – Investors get more for their money by purchasing uncompleted houses at a lower market price.

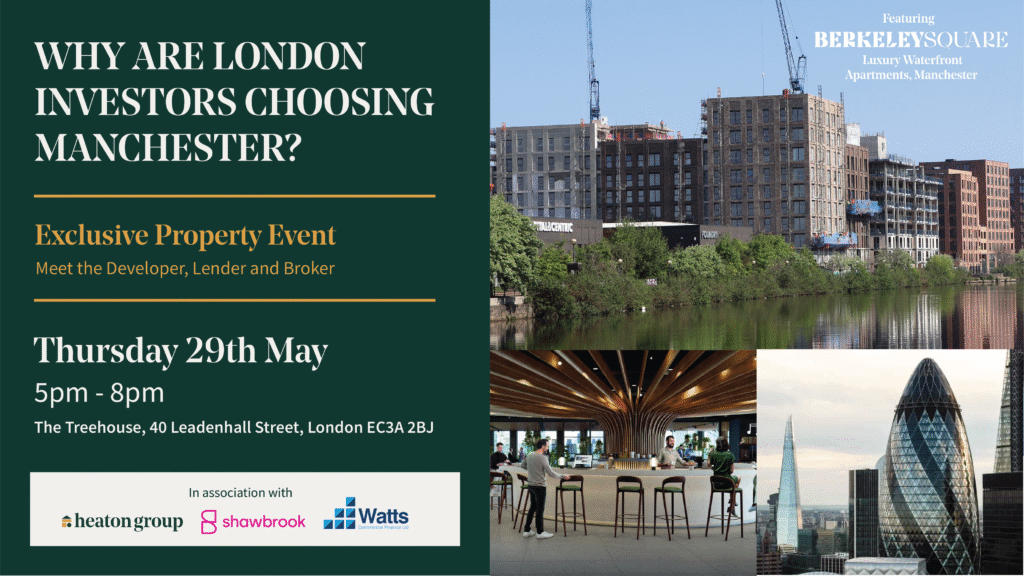

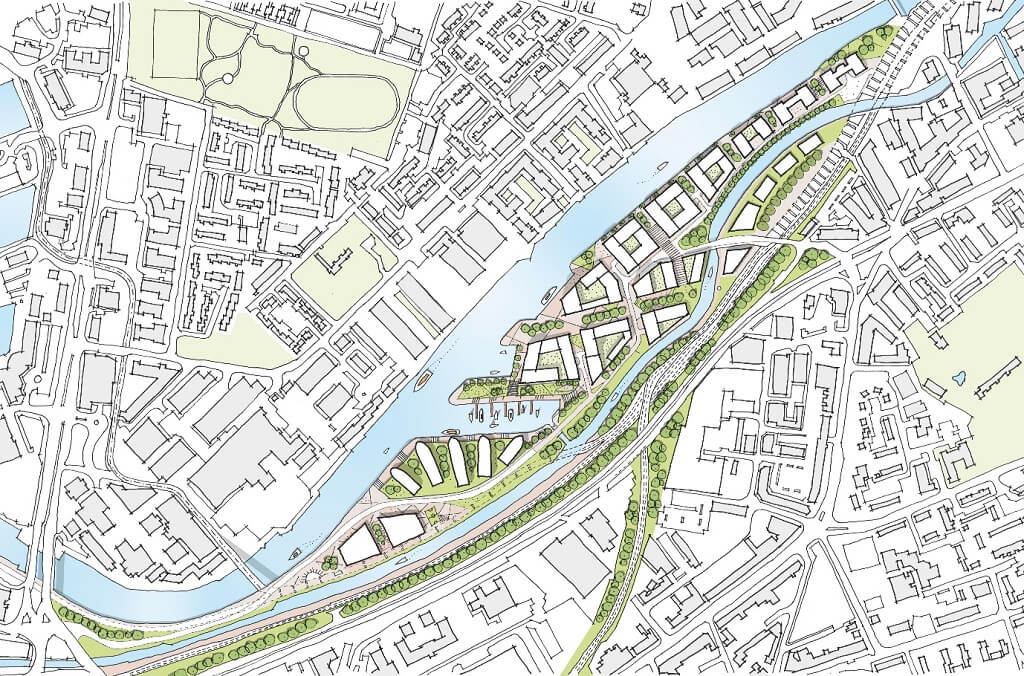

- High rental demand – New builds with new amenities are always in higher demand, in particular apartments in key areas such as city centers. Take a look at our exciting new development Berkeley Square nestled between MediaCityUK & Manchester, offering a 5-7% rental yield.

- Greater choice – Off-plan property buyers have first choice over other investors, choosing the best units and cherry-picking those that suit their needs best.

- Market growth – Property values can increase during the time of construction, this could allow you to flip the property and get profit when construction has finished.

- Flexibility – Whether you use your unit for rental income while waiting for the best time to sell or flip it when construction has finished, the choice is yours.

But, as we know, there is no good without the bad. Some potential risks if you’re looking to buy off-plan property are –

- The property prices could fall by the time building completion is finished, this is why investing in high-demand areas such as Manchester and Preston is key.

- Your developer might fail to complete the construction, which is why choosing developers like us at The Heaton Group who have a track record of previously successful developments is key.

- Construction may be delayed.

At The Heaton Group, we deal with developing in the North of England, focusing on high-demand, fast-growing areas such as Manchester and Preston.

For off-plan development, we care about creating a win-win relationship with our investors, providing lower-than-market prices for our developments, and helping them build their investor portfolio. With 50 years in the business and over 1,600 homes built, 97% of new investors say they loved our building designs.

How To Buy Off-Plan Property In England – Things To Consider

For first-time off-plan property investors, the process is different from buying a home, for overseas investors there are also more requirements.

For off-plan property investors overseas you need to consider the following before making a purchase –

- Deposit requirements – Overseas investors for off-plan property may need to pay a higher deposit than UK buyers and a surcharge for Stamp Duty Land Tax. Labour plans to tax overseas investors more in the coming years. ⁴

- Paying UK tax – To invest in an off-plan property in England you will need to pay income tax on your UK property income. Therefore, having your letting agent handle this may be more useful.

For all investors, these are key considerations before choosing your off-plan property and developer –

- Location – The location that you choose to invest in off-plan property will determine housing prices, rental demand, and ultimately more ROI in the long term. Choosing high-demand areas like Preston with job growth and a large young professional population are safe bets since growth will be likely in the coming years.

- Reputable developers – Choose developers, like us at The Heaton Group who have lots of successful developments in your chosen area. Look at the stats and research to back up their claims.

- Incentives – Look for incentives as an off-plan property buyer like discounts, Stamp Land Duty Tax already paid, or furniture packages.

- End goal – Think about how long you will be holding your property before selling at your ideal house price. Make sure the predicted rental income and capital growth will meet your goals.

Top Locations For Off-Plan Property Investment UK

Location is everything. Choosing a poor location for an off-plan property investment could even cause your house to decrease in market value after construction resulting in an investment loss.

High-demand areas in the UK are mostly up North. The North of England has an average rental yield of 6-8%,⁵ affordable housing prices, growing economies, population, and capital appreciation.

These are the best investment hotspots in the UK for both local and overseas investors in off-plan property.

- Manchester – With a growing population of 2,812,000 in 2024, a 0.75% increase from 2023⁶ and strong rental demand, Manchester is an excellent off-plan property investment location.

- Preston – Preston’s growing economy and more employment opportunities thanks to city development plans such as the City Deal are making Preston a highly sought after area for investors. Check out the success of our development Bishopgate Gardens in Preston here.

- Salford – Offering above average rental yields but more affordable housing prices than Manchester, Salford is excellent for first-time investors. With a bustling student population thanks to the University Of Salford, student accommodation is a great investment choice, plus, it has easy transport links to Manchester.

- Bolton – Rated 6th in the UK for property market growth ⁷, Bolton is showing signs of becoming a buy-to-let hotspot. Property prices on average are £209,455 considerably lower than Manchester ⁸. You can get great off-plan property prices here with high capital growth.

- Liverpool – With a high demand and strong capital growth, Liverpool can give great returns. It’s very popular with US overseas investors too thanks to its study opportunities, Liverpool Football Club, and transport links.

- Leeds – Leeds has a growing young population and is the leader of the Northern Powerhouse scheme, having the fastest growth rate of private sector jobs in the UK.⁹ House prices here are affordable, and rental yield is high.

- Birmingham – A promising destination for both overseas investors and off-plan property investors in the UK. JLL is predicting a 9.3% increase for the West Midlands area from now till 2027.¹⁰ Birmingham is also home to many young professional graduates with a retention rate of 41% ¹¹, making it lucrative for investors with buy-to-let single-occupancy apartments.

Buy Off Plan Property In Manchester & North West England – The Heaton Group

At The Heaton Group, we only ever offer quality, luxury and in high-demand developments based in the North of England. We focus on key areas such as Preston, Manchester, Salford, and Bolton.

Our developments have an average rental yield of 6.9%, consisting of high-spec modern designs. All of our developments have been successful, bringing a high ROI for our investors, especially when purchasing off-plan property.

Our developments aren’t just about the property, we also recognise how they can be integral to communities, become historic landmarks, and give towns character, which is why we build for generations to come.

To learn more about our current off-plan property investment opportunities in the UK or ask questions about our previous developments for local or overseas investors, contact us today.

Sources

- High mortgage rates reduce off-plan sales to historic low

- Mortgage Rates And House Price Forecast – Forbes Advisor UK

- Mortgage Rates And House Price Forecast – Forbes Advisor UK

- Buying Property in the UK: A Guide for Foreigners, Expats and Overseas Investors

- The highest yielding areas for buy-to-let property in the UK

- Manchester, UK Metro Area Population 1950-2024 | MacroTrends

- Bolton property market recording increases in value

- House Prices in Bolton

- Leeds economy

- Demand for Birmingham Property

- Graduate Retention: Best UK Cities at Keeping Students After Graduation