Thinking about investing in a rental property and becoming a landlord? Buying a buy-to-let property is different from purchasing a residential property since it requires more analytical research to ensure you get the best ROI.

Whether you’re an overseas investor or based locally, one of the key points to consider when choosing buy-to-let properties is location. The north of England offers excellent rental yields averaging 6-8% and much lower house prices than London.¹

Let’s discuss everything you need to know about buy-to-let properties below so you can be confident in your choice of rental property and get the best return on your investment.

Table of contents

The Key Things To Consider When Looking For Buy-To-Let Properties

It’s important to consider that a rental property has to appeal to your target customers rather than personal preference.

We recommend considering these tips when choosing a buy-to-let property.

Selecting a Trusted Partner

Choosing a reliable development company is important when buying a buy-to-let property.

The company should have a track record of successful previous developments and local expertise, which will allow them to advise on the best rental yield locations according to your target customers.

Avoid start-up companies with a lack of experience or no previous investor testimonials; this reduces the risk of construction delays or legal issues.

The Heaton Group is a family-run business with over 50 years in the industry and has completed several successful buy-to-let developments in the north of England. Some of these developments are The Exchange, Bishopgate Gardens and The Sorting Office.

Target Tenants

Your ideal target tenants should be guided by which buy-to-let properties you are looking at. For young professionals or students, choosing a property in the city centre near to local universities would be ideal.

However, for families, a buy-to-let property on the outskirts of the city might be more suitable.

Location

Location is everything when choosing buy-to-let properties, and it can affect the desirability of your property. Consider access to healthcare, airports, transport, schools and shops.

This also has a direct effect on your rental yield and capital appreciation, with properties down in London having a lower rental yield than up North.

Capital Appreciation

Consider the potential resale value of your buy-to-let property in the long term. Are house prices in this area set to rise due to demand?

In areas like Manchester, house prices are set to increase by 4-5% in 2025 thanks to regeneration projects and other developments like the Northern Powerhouse.².

Rental Yields

The average rental yield is an important figure for any prospective landlord to consider when choosing the location of a buy-to-let property. For the north of England, you can expect an extremely high rental yield of up to 9.58% for studio apartments.³

Internal Spec

Does the internal spec of your buy-to-let property match your target tenants’ needs? Is it modern or does it need renovation? Investing in the interior of a rental property can be a profit loss, especially if your tenants mistreat the house in the long run.

Look for an easy to maintain interior and choose in-person visits before purchasing to assess the build quality.

Look At Previous Investor’s Experiences

Search for previous investors’ testimonials so you can learn more about their reputation.

Especially as an overseas buyer, you want to ensure the developers provide enough insight and support into the investing process.

The Heaton Group has all of our case studies here, and 97% of investors say they love our building designs. We have a 4.8-star rating on Google reviews as well as 4.5 star on Trustpilot.

Considering Buy To Let Mortgage

One of the most searched steps about buying a buy-to-let is the buy-to-let mortgage option.

You need to make sure you’re eligible for a BLT mortgage and have enough for a deposit which tends to be higher than a standard residential mortgage.

There are also higher interest rates to consider and stamp duty tax. For overseas investors in particular you need to be aware of additional tax charges and the potential need for a property management company to help handle your rental investment.

Investing In Buy To Let Properties Up North With The Heaton Group

The Heaton Group has over 50 years experience in highly successful developments in areas such as Manchester, Salford, and Preston as well as other locations in North West England.

We work closely with investors to create a win-win relationship. All of our builds have a 10-year structural warranty and we provide access to properties below market value during the construction phase, maximising capital appreciation for beginner investors.

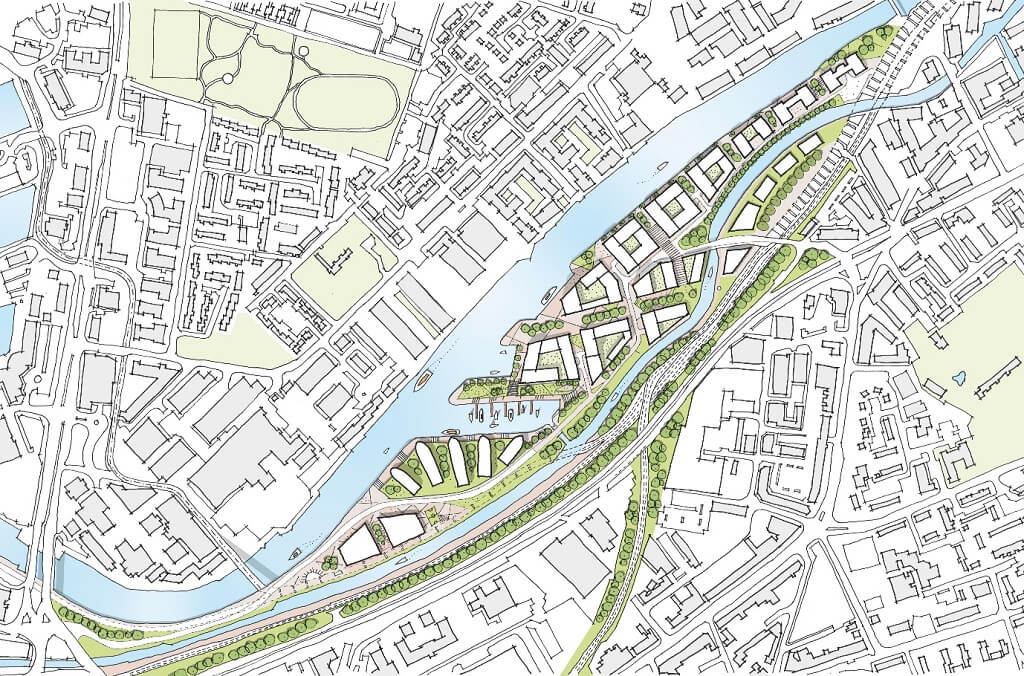

You can check out our successful buy-to-let developments such as Urban Green consisting of 176 luxury apartments or Berkeley Square for an off-plan investment opportunity in the heart of MediaCityUK and Manchester.

Contact us today and we will answer any questions about buying a buy-to-let with The Heaton Group and our buy to let properties for sale.

Sources

- The highest yielding areas for buy-to-let property in the UK – Zoopla

- Savills UK | Savills upgrades five-year forecast for UK house price growth

- Rental Yields in the United Kingdom in 2024, Q2 | Global Property Guide