Various schemes are available to help first-time buyers own a home, including shared ownership and rent-to-buy. Here’s what you need to know about these schemes.

Table of contents

Key Takeaways

- The Lifetime ISA encourages first-time home buyers and those saving for retirement by offering a 25% government bonus on savings up to £4,000 annually, with restrictions on property price and penalties for unauthorised withdrawals.

- Shared ownership allows buyers to purchase a portion of a property and pay rent on the rest, offering a more affordable entry into homeownership. Still, it may come with issues like rising service charges and difficulties in selling.

- Rent to Buy in England allows tenants to rent homes at a 20% discount to save for a deposit, with an option to buy after saving enough for a mortgage.

- The London Living Rent scheme targets those living or working in London. It offers rent-to-buy options to individuals with household incomes under £60,000, aiming to help them save towards purchasing a home.

- First Homes scheme offers first-time buyers in England homes at 30% to 50% below market value, aiming to make homeownership more accessible, with specific price caps outside and within London.

The Lifetime ISA

Launched in 2017, this savings account aims to help you buy your first home (or save for later life). It enables savers to pay up to £4,000 annually until age 50.

The big plus: the government will add a 25% bonus, up to a maximum of £1,000 annually. You must be between 18 and 40 years old to open one.

To qualify, the property must be worth £450,000 or less and purchased with savings from the ISA. This may be challenging in parts of the UK as property prices are more expensive in more populated areas. Savers who withdraw their money to spend on a property above the price cap face a 25% charge for an unauthorised withdrawal. This is designed to recover the government bonus but also controversially claws back some of the original investment.

Shared Ownership

When you buy in a shared ownership scheme, you purchase a share of a new-build or resale property, usually 25% to 75%. Sometimes, you can buy as little as 10%. You will then pay rent on the remaining share you do not own.

In the case of a flat, you may also need to pay a service charge to cover the expenses of maintaining the building.

As you’re buying only a share of the place, you will only need a mortgage for that share. It is typically issued with a combined deposit and loan, which will be smaller than expected in a full, single-loan home. And the rent will be less than what is paid on the open market—usually about 2.75% of the value of the share the landlord owns in a year—though, of course, you have to bear future increases in mind.

However, some of the owners have complained about service charges escalating, problems of alleged poor quality of the building maintenance, a time-consuming lease-extension process, and restrictions on the lease, all of which can make selling up difficult.

The tenant under the scheme will have the option of living in it for 20% less than the local market value. A huge benefit is that you can purchase further shares until 100% of the home belongs to you.

This is called staircasing.

There are different rules in England, Scotland, Wales, and Northern Ireland. In the rest of England, to qualify, you must have an annual household income of £80,000 or less—£90,000 or less in London. A few housing associations and local authorities have their conditions for who is considered a priority and affordability.

Rent to buy

Under this scheme, tenants in England will be offered the opportunity to rent a home with a typical 20% discount off the local market rent to help them save for a deposit.

To qualify, you must be employed, eligible for first-time homebuyers, and able to meet rent expenses while saving up for a deposit simultaneously.

If you live in England, organisations with rent-to-buy homes under the service for shared ownership scheme can be found in your local area.

The first up-to-tenancy agreement will be up to two years, though it may be possible to extend it if you need more time to save for your deposit.

Tenants can buy their home as soon as they have saved up a deposit and can get a mortgage.

This is not available in Scotland. The rent-to-own scheme in Wales closed to new landlords on June 3, 2011. However, a few properties may still be available under the old scheme. In Northern Ireland, there is an equivalent scheme.

London living rent

This is the capital’s version of rent-to-buy. To be eligible, applicants should live or work in London; reside in private rented accommodation (or another kind of formal tenancy) or reside with friends and family; have a maximum household income of £60,000; and not own a home.

They must also be unable to buy in the area where they live, including through shared ownership.

First Homes

This is an English government scheme. It allows first-time buyers to own a home valued between 30% to 50% of the market value. There is no rent payable, just like in shared ownership.

You may choose properties that are advertised by developers and estate agents and are most probably located within the area. Developers offer homes that are less than 30% off market value.

You will be considered buying a home if you buy one that is eligible under the scheme—for example, a new build or one purchased through the scheme previously by someone else. You must not have a household income of more than £80,000 a year before tax (£90,000 in London). If you are buying with someone else, then the other person should be a first-time buyer, and the combined income of that person with you should not be more than £80,000. Individual councils may set extra conditions.

Outside London: New-build First Homes should not exceed a maximum price of £250,000 after a discount.

In London: The New-build First Homes should not exceed the threshold of £420,000 after a discount.

How we can help in your property journey

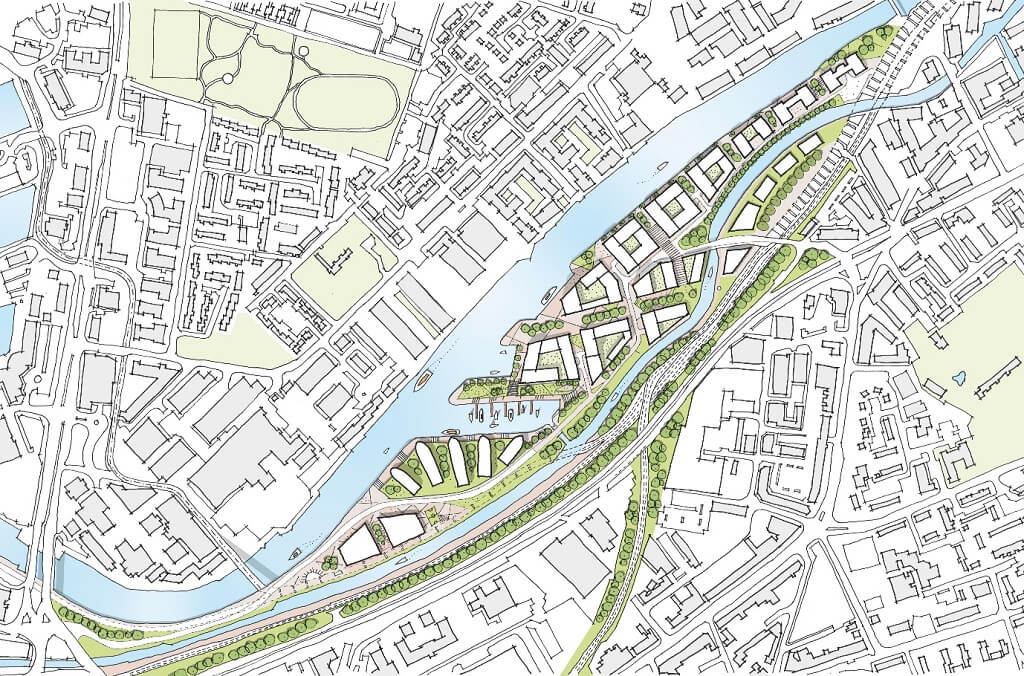

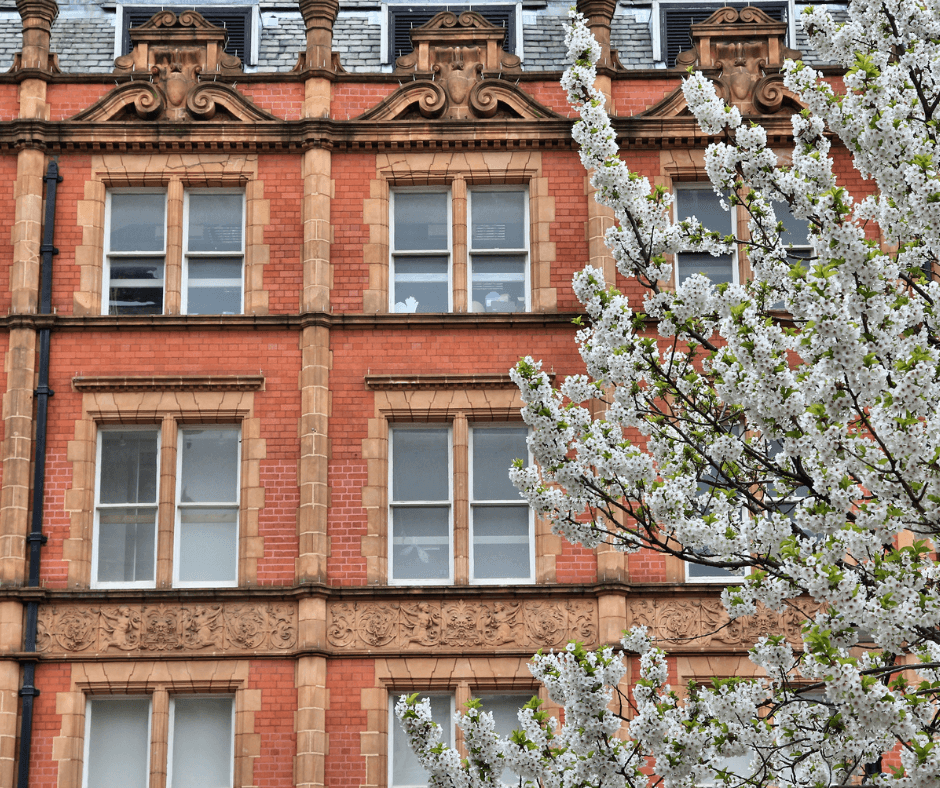

We are well-known for building high-quality homes, which has made us a significant player in the market for people looking to buy their first home. By offering properties at below-market value, we are providing an opportunity for first-time buyers to get on the property ladder.

We design homes with the contemporary homeowner in mind, providing sustainability and modern living. Prospective homebuyers can browse our portfolio to find suitable properties that offer comfort, style, and quality. This partnership showcases the potential of property development in making homeownership a reality for more people in the UK.