Cautious optimism returns to the market, but location remains key.

The latest reports from the most credible property sources show that the UK property market is beginning to turn positive. Still, buy-to-let investors should pay close attention to location.

Savills identified for key takeaways from their latest property analysis:

- The UK property market has proved more positive than they previously thought.

- Their short-term forecast for future price growth has improved.

- Longer-term growth looks even more positive

- Monthly fluctuations may occur due to short-term mortgage rate volatility.

Why has the market done better than anticipated?

Nationwide price report has shown that the UK housing market has risen marginally in 2024. Prices are up by 1.1% according to their metric. Savills attributed this increase to lower mortgage rates with longer-term fixed rates below the Bank of England base rate, which remains at 5.25%. This has given buyers confidence that the market is stabilising. Added to this, lenders have more confidence in the market with more flexible lending criteria. The net result is that mortgage approvals moved above 60,000 for the first time since September 2022.

Why has Savills uplifted its short-term house price projections?

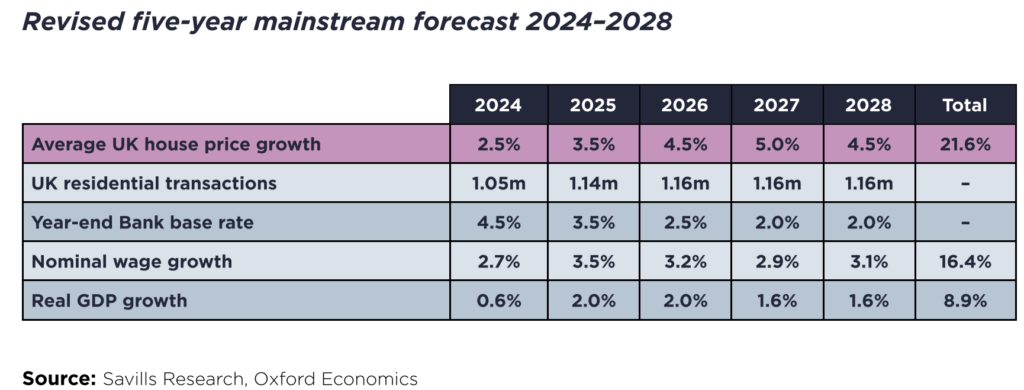

Positive sentiment is slowly returning to the UK property market. One of the biggest contributors to this is the control of inflation. Double-digit inflation now seems a thing of the past, with headline inflation down to 3.2% compared to 11.2% at the end of 2022. This makes consumers think interest rates will fall, resulting in cheaper mortgage rates. Buyers will slowly have more affordability to buy. This is important as mortgages are still far cheaper than rent. As a result, Savills predicts a positive 2024, with prices rising by 2.5% across the board.

Why is Savills increasing its long-term price projections?

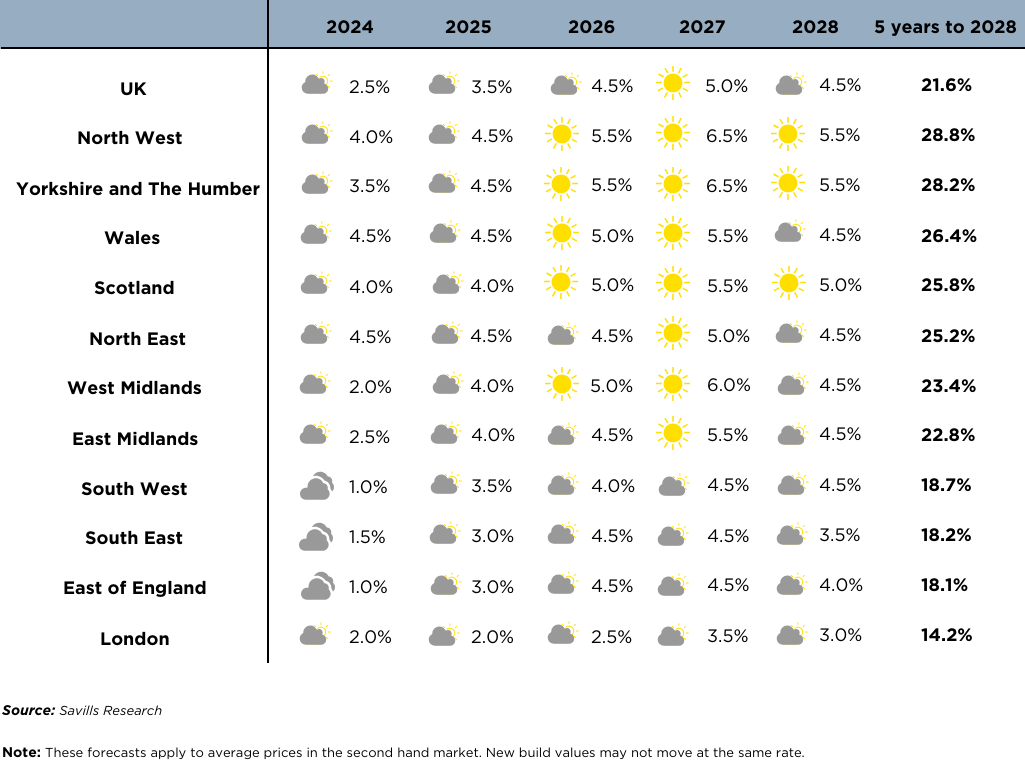

Savills has upped its 5-year forecast on property to 21.6%. However, these figures change dramatically when looking at location. The Northwest, such as Manchester, is in line for the highest growth at 28.8%, 14% higher than London-based properties.

The reason for this projected growth is the improvement of the economy. Oxford Economics forecast for GDP growth over the next five years has increased from 7.2% to 8.9% and wage growth from 15.8% to 16.4%.

More importantly, interest rates are likely to fall dramatically. The base rate is projected to be at 3.5% by the end of 2025 and 2.5% by the end of 2026. This cuts the cost of borrowing, resulting in increased affordability. For buy-to-let investors, this means more profit from both income and capital growth.

Why are house prices fluctuating from month to month?

Savills has analysed the political landscape and understands that economics are more volatile in the months before and after a general election. Financial markets have a habit of reacting in the short term to political decisions. However, the longer-term forecast is beginning to look very strong.

The Heaton Group View

The economic forecasts are encouraging. Higher property rises are on the horizon. Property investors should focus on where they invest. The North West is showing far greater potential for growth. Yields also tend to be higher, increasing profitability further. Manchester-centric investors can expect 15% more capital appreciation compared to London-focused investors.

In the short term, interest rates remain high, which results in higher mortgage rates and reduced profit. A great solution is to opt for an off-plan property. Interest rates are expected to be around 3% in 2026, compared to 5.25% currently. This results in over £2,000 per year in mortgage savings for every £100,000 borrowed. This, coupled with buying below market value, makes the ideal option for more savvy investors.

Sources