Manchester has firmly established itself as one of the UK’s top property investment destinations. Often referred to as the “Capital of the North,” the city is undergoing rapid transformation, fuelled by extensive regeneration projects and an influx of both domestic and international investment.

With a booming economy, excellent transport links—including Manchester Airport and the Metrolink—and a growing population, the city presents great opportunities for investors looking to maximise returns.

Table of contents

- Is Manchester a Good Place to Invest in Property?

- Best Areas in Manchester for Property Investment in 2025

- Featured Manchester Developments by The Heaton Group

- Off-Plan vs. Built Properties: Which is the Better Investment?

- Manchester Property Market Forecast – What to Expect in 2025 & Beyond

- Buy-to-Let in Manchester: How to Maximise Rental Yield

- FAQ’s About Property Investment in Manchester

- Final Thoughts

Is Manchester a Good Place to Invest in Property?

Manchester has consistently ranked as one of the best locations for buy-to-let investment in the UK. It boasts strong economic growth, high rental yields, and a growing population, making it an ideal location for investors seeking long-term capital appreciation and robust rental income.

Why Manchester is the UK’s top buy-to-let hotspot?

- Over 120,000 students attend Manchester’s universities, ensuring high rental demand year-round.

- Rental yields average between 6-7%, far outpacing London’s 3.5%.

- The city’s diverse employment base—including tech, finance, and creative industries—creates a steady influx of young professionals in need of housing.

Property price growth & rental yield trends

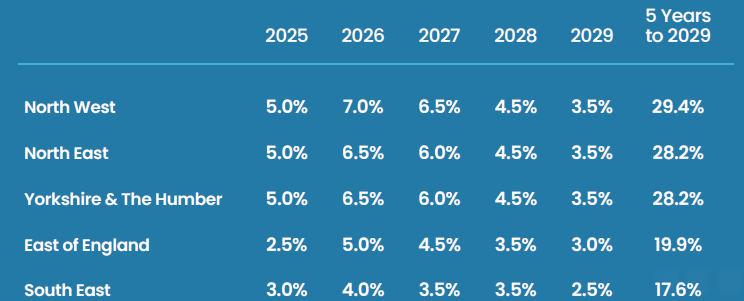

According to JLL’s UK Residential Forecast, property prices in Manchester are expected to increase by 29.4% over the next five years, reinforcing its reputation as a high-growth investment location.

Best Areas in Manchester for Property Investment in 2025

Selecting the right area is important for maximising returns. Here are the top investment hotspots in Manchester:

| Area | Average Yield (%) | Tenant Demand | Key Attraction |

|---|---|---|---|

| Salford | 7-8% | High | MediaCityUK, BBC, ITV |

| Ancoats | 6-7% | Very High | Trendy, young professionals |

| Fallowfield | 8%+ | Extremely High | Student area, University of Manchester |

| Trafford & Altrincham | 5-6% | High | Family-friendly, top schools |

For the latest Manchester rental yield data, visit Rightmove’s Manchester House Prices.

Featured Manchester Developments by The Heaton Group

Check out our flagship developments in Manchester, which are built to deliver strong rental returns and lasting value.

- Berkeley Square Manchester – Prices from £240K, offering rental yields up to 7%

- Tranquillity Manchester – Prices range from £222K, and delivering rental yields up to 7%.

For more investment opportunities, visit The Heaton Group.

Off-Plan vs. Built Properties: Which is the Better Investment?

Understanding the benefits of off-plan and completed properties can help you make an informed decision.

- Off-Plan Properties: Lower entry prices, higher capital growth potential, and modern designs. However, investors must account for potential delays.

- Completed Properties: Immediate rental income but may require renovations or modernisation to remain competitive.

For guidance on off-plan investments, check the UK Gov Planning Portal.

Manchester Property Market Forecast – What to Expect in 2025 & Beyond

The Manchester property market is set to continue its upward trajectory.

- Property prices are expected to rise by 29.4% between 2025 and 2029 (Savills UK Housing Market Update).

- Rental prices forecasted to grow by 6.1% in 2024, outpacing many other UK cities.

- Major infrastructure projects, including Manchester United’s £4.2bn stadium plan and city-centre regeneration, will further drive demand.

For more insights, see Zoopla’s rental market trends.

Buy-to-Let in Manchester: How to Maximise Rental Yield

Investors can boost rental income by:

- Targeting high-yield areas such as Salford.

- Offering modern, well-maintained properties to attract professionals.

- Minimising void periods by setting competitive rent prices

For updated rental data, check HomeLet Rental Index.

FAQ’s About Property Investment in Manchester

Yes, with strong rental yields (6-7%), rising property values, and increasing tenant demand, Manchester is one of the UK’s best investment destinations.

Manchester provides higher rental yields (6-7%), significantly lower property prices, and better affordability compared to London’s 3.5% average yield.

Yes, off-plan properties offer lower purchase prices and high capital growth potential, but selecting a trusted developer is key.

With over 120,000 students, a booming tech and finance sector, and major employers like BBC and Amazon, demand for rental properties remains strong.

Absolutely! Berkeley Square Manchester and Tranquillity Manchester provide up to 7% rental yields in high-demand areas, offering both security and growth potential. Don’t believe us? Check our reviews – Google Reviews & Trustpilot Reviews

Final Thoughts

Manchester is one of the most promising cities for property investment in the UK. With high rental yields, strong capital growth, and a steady demand for housing, it’s an attractive option for investors looking for both immediate returns and long-term gains.

If you’re considering investing, now is the time to take advantage of Manchester’s booming market. Check out The Heaton Group’s developments or get in touch with our team for expert advice on securing the right investment for you.